INVESTORS' INSIGHTS:

Week Ended August 18, 2013

FIRST FINANCIAL INSIGHTS

"Investors' Insights"

"Investors' Insights"

VISIT OUR WEBSITE

Many months#

ago we actually concluded that without Steve Jobs the company would not

be able to repeat or meet the achievements or expectations of its

founder. There is an artistic-creative element in people of Steve's

character that cannot be replicated by professionally trained managers

from Ivy-league business schools.

Moreover, entrepreneurial vision and drive is a talent few ever configure in a similar way.

Moreover, entrepreneurial vision and drive is a talent few ever configure in a similar way.

So

whether its Ford, Buffet, Carnegie, Gates, Stronich or Jobs, their

unique compositions are rare and the companies they build and run are

never the same once they move on.

Keeping Apple on the watch list, but our vision for the future remains short-sighted.

INVESTORS' INSIGHTS

First Financial Insights

August 16, 2013

# The Dr Peter G Kinesa Blog - Where Marc Faber Sees Apple (APPL) Going

Doghouse- is that what I dressed for?

One

primary rule of investing - when the Company's top executives start

dumping their shares, it's time to head for the hills. We are not going

to set out all the reasons why and all the excuses executives use to

justify their dispositions. Nope, instead we are going to ask you to

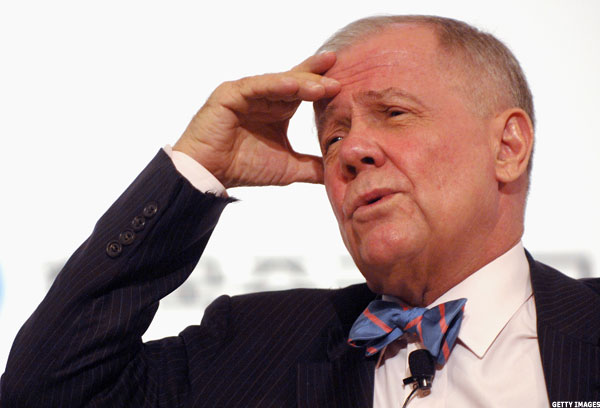

look at the fellow captioned above and ask "what if this guy started dumping shares in that small town company from Omaha?"

Never happened, and if it did - you know that the flood waters are really coming.

It

all boils down to how do you believe in folks that do not believe in

themselves? Just plain-old folksy small-town stuff. There is however-

one City-slicker - Jimmy Rogers, who thinks that Facebook is not an investment, its a waste of time. We agreed with him then, and still do.

This also may explain why Facebook users are so depressed - they finally figured out Jim's astute observation.

This also may explain why Facebook users are so depressed - they finally figured out Jim's astute observation.

Stockholders may soon join its users, as t is still just a click away from ten or less, on the Ticker.

INVESTORS' INSIGHTS

First Financial Insights

August 14, 2013

WISE GUY

" Facebook is not an investment, it's a waste of time"

TORONTO CONDO bubble CRASHING – WHAT NEXT? - READ MORE 2008 Meltdown or Japanese Bubble... (read more)

When will they ever learn? Or is it simply in the nature of our species to always create these gigantic credit-driven asset bubbles? And why is it a social phenomenon that no country, culture or region is immune to through-out history?

From a investment view, we are seriously perturbed about Toronto's Condo Bubble and the possible outcomes that could occur when the bubble further deflates. As a result, we have placed a number of sectors on our watch list; obviously including retail, financial, property development and construction industries. In the weeks ahead, we will provide further.comments and analysis regarding the much anticipated fall-out with more specific industry assessments.

Remember also how globalization was sold to us as the best way to improve national economic well-being, standards of living, create jobs and lower risk levels. Now everything is so deeply inter-connected financially, physically and politically, yet these promised improvements seem to be moving us in the opposite direction. Do you think it was all a big lie serving a few special global interests? Do you think that they pulled the wool over the eyes of our political geniuses? If you do - then you are not alone!

It begs the question - who is really governing sovereign nations given all the operative trade agreements, and organizations, such as the WTO, EU, IMF, World Bank and others, with relegated powers? Have all these supra-constitutional connections watered-down sovereign constitutions so much that national destinies have been moved beyond elected officials' powers? This may explain why Canada patterned its monetary policies after the FED - they have to!

This is a big issue that requires a good deal more analysis and thought, but there are clear hints that "globalization" was just a crafty synonym disguising "annexation". What does that have to do with the price of Condo's in Toronto?

Lots! Just ask its Mayor.

INVESTORS' INSIGHTS

First Financial Insights

August 12, 2013

Asset Bubbles 101:

In the end, remember nothing is...